What Is the Interest Coverage Ratio?

Dicembre 4, 2023

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Therefore, the firm would be required to reduce the loan amount and raise funds internally as the Bank will not accept the Times Interest Earned Ratio. The significance of the interest coverage ratio value will be determined by the amount of risk you’re comfortable with as an investor.

What is the financial ratio interest coverage?

A high times interest earned ratio equation will indicate a good level of earnings that it more than the interest to be repaid. A strong balance sheet is what every investor desires in order to take a positive investment decision about a company. It not only increases the faith and trust of investors but also raises the chance of the business to obtain more credit from lenders since they are sure to get back the money they decide to lend. By comparing a company’s earnings before interest and taxes (EBIT) to its interest expenses, the TIE ratio offers a clear picture of financial health.

Real examples: Lockheed Martin Corp vs. Boeing Company

A higher TIE ratio suggests that the company is generating sufficient earnings to comfortably cover its interest payments, indicating lower financial risk. Conversely, a lower TIE ratio may signal financial distress, where the company struggles to manage its interest payments, posing a higher risk to creditors and investors. As economic downturns have a significant impact on all accounting operations of a business, it also possesses the ability to turn a good TIE ratio into a low TIE ratio, which hinders business growth. This means that you will not find your business able to satisfy moneylenders and secure your dividends.

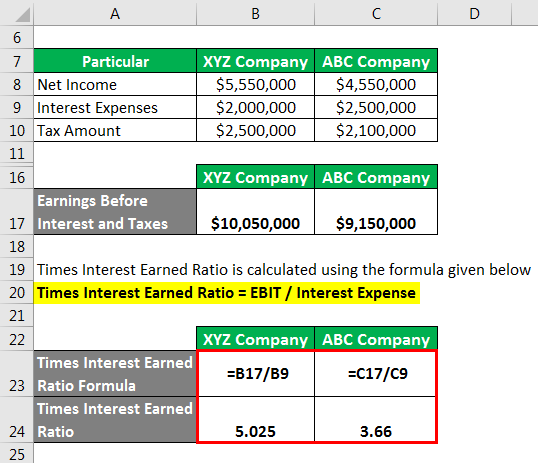

Calculating business times interest earned

So you now know the TIE ratio formula, let’s consider this example so you can understand how to find times interest earned in real life. So, for a company to be sustainable, money coming in has to be enough to cover debt interests, if any, and taxes. A company’s capitalization is the amount of money it has raised by issuing stock or debt, and those choices impact its TIE ratio. Businesses consider the cost of capital for stock and debt and use that cost to make decisions. For companies without debt or minimal interest expenses, the TIE ratio may be less relevant. Other financial metrics would be more applicable in such cases.

- Looking at a company’s ratios every quarter over many years lets investors know whether the ratio is improving, declining, or stable.

- By analyzing TIE in conjunction with these metrics, you get a better understanding of the company’s overall financial health and debt management strategy.

- So you now know the TIE ratio formula, let’s consider this example so you can understand how to find times interest earned in real life.

- If the TIE ratio is exactly 1, it means the company’s EBIT is just enough to cover its interest expenses, leaving no room for error or additional financial strain.

A high TIE ratio indicates that a company has a strong ability to cover its interest expenses, suggesting lower financial risk. By analyzing TIE in conjunction with these metrics, you get a better understanding of the company’s overall financial health and debt management strategy. If you have a $10,000 line of credit with a 10 percent monthly interest rate, your current expected interest will be $1,000 this month. If you have another loan of $5,000 with a 5 percent monthly interest rate, you will owe $250 extra after the interest is processed. Your total interest expense for this month, then, is $1,250. The higher the TIE, the better the chances you can honor your obligations.

What is the TIE ratio if the EBIT is twice the amount of total interest?

Analyzing interest coverage ratios over time will often give a clearer picture of a company’s position and trajectory. As you can see, creditors would favor a company with a much higher times interest ratio because it shows the company can afford to pay its interest payments when they come due. Higher ratios are less risky while lower ratios indicate credit risk. The different debt analysis tools, such as current ratio irs says business meals are tax deductible calculator and the quick ratio calculator, are complementary to the interest coverage ratio calculator because they show different information. The latter focuses on cash inflows and outflows rather than on current assets and current liabilities like the former one. Times interest earned ratio is a debt ratio whose purpose is to allow investors and creditors to measure the level of financial risk the company has.

Note that for Lockheed Martin, the coverage ratio is high and stable. That is why people consider it a reliable company worth having in their retirement investing plan. This section will compare Lockheed Martin Corp and Boeing Company, both related to the airplane manufacturing industry, based on their interest coverage ratio. The problem happens if we are getting close to a value of 1.

The founders each have “company credit cards” they use to furnish their houses and take vacations. The total balance on those credit cards is $50,000 with an annual interest rate of 20 percent. Ultimately, you must allocate a percentage for your varied taxes and any interest collected on loans or other debts. Your net income is the amount you’ll be left with after factoring in these outflows. Any chunk of that income invested in the company is referred to as retained earnings.

An interest coverage ratio of 1.5 is one where lenders will likely refuse to lend the company more money, as the company’s risk for default may be perceived as high. If a company’s ratio is below one, it will likely need to spend some of its cash reserves to meet the difference or borrow more. Lenders use the TIE ratio as part of their credit analysis to assess a company’s creditworthiness. A higher TIE ratio generally indicates a lower credit risk, which may result in more favorable lending terms and conditions for the borrower.

However, as a general rule of thumb, a TIE ratio of 1.5 to 2 is often considered the minimum acceptable margin for assuring creditors that the company can fulfill its interest obligations. Based on the times interest earned formula, Hold the Mustard has a TIE ratio of 80, which is well above acceptable. As we previously discussed, there is a lot more than this basic equation that goes into a lender’s decision. But you are on top of your current debts and their respective interest rates, and this will absolutely play into the lender’s decision process. A poor interest coverage ratio, such as below one, means the company’s current earnings are insufficient to service its outstanding debt.